Table of Contents

- Question 1: What Is Your Survey Tool Designed to Do?

- Question 2: Does Your Survey Data Highlight Targeted Improvement Opportunities?

- Question 3: Will Your System Scale?

- Question 4: Where Will You Get Your Survey Questions?

- Question 5: What Will Your Time to Value Be?

- Question 6: What Will Your Maintenance Costs Be?

- To Build a Work Measurement Machine, You Need to Understand Frameworks and Methodology behind the Surveys

Build vs. Buy FOUNT: 6 Questions to Ask

Can you build a FOUNT-like system in-house? Before investing time and resources, consider six key factors - including survey structure, scalability, and long-term maintenance. This article breaks down what it takes to create a decision-ready work measurement system and why many enterprises find that building internally is more complex, costly, and time-intensive than expected.

KEY TAKEAWAYS

- Measuring employee work is an excellent way to identify opportunities to increase productivity, reduce costs, and improve employee experience.

- When deciding whether to build or buy a platform to measure work, consider things like time to value, in-house expertise, and maintenance costs.

- Key to success is a system that measures NOT how employees experience changes but rather how changes YOU make impact employee experience.

If you’re considering FOUNT as a way to get clear, actionable data on employee work and how to make it better, you’ve probably wondered whether you can build a FOUNT-like system internally.

After all, you likely already have the ability to run internal surveys. You no doubt have an IT team capable of capturing data from those surveys and using it to power dashboards that track responses. Why not combine those capabilities to create an in-house version of FOUNT offering?

It’s a question we hear sometimes. In this post, we help you answer it by outlining six questions to answer internally as you consider whether to create a home-grown version of FOUNT. We’ll also touch on how to think more realistically about resources you’ll need to build vs. buy.

Question 1: What Is Your Survey Tool Designed to Do?

Classic survey tools like Qualtrics and Medallia are often used to uncover how employees’ experience changes about their work, not to evaluate specific tasks or workflows where friction might occur. FOUNT was purposely built as a work friction tracking platform that uses targeted surveys as one part of its system. It’s not just about surveys – it’s about the combination of content, methodology, scoping tools, data analytics, and dashboards. All to provide decision-ready insights into how work gets done – and where it’s being slowed down.

For example, you may learn from a traditional employee engagement survey (or tool survey) that workers aren’t crazy about a new AI copilot intended to increase their coding output (Figure 1). The open-text responses may even offer some insight as to why: it works well for some tasks but not others, so it’s sometimes faster to do the work the old way.

That’s good to know – but it doesn’t offer any actionable insight into how you might improve the copilot.

FOUNT is designed to go deeper. It can identify, for example, which specific work tasks the copilot is making more difficult (generating new code? Reviewing pull requests? Creating documentation?) for which employee populations (junior developers? Senior? Those newer to your org?). This brings us to our next question.

Question 2: Does Your Survey Data Highlight Targeted Improvement Opportunities?

If you’ve ever struggled to get employees to answer internal surveys, you understand the problem of survey fatigue. One major driver of survey fatigue? Too many organizations don’t do anything based on the data they gather from surveys. Or else they don’t clearly communicate what they are doing. The result: employees see little point in providing answers.

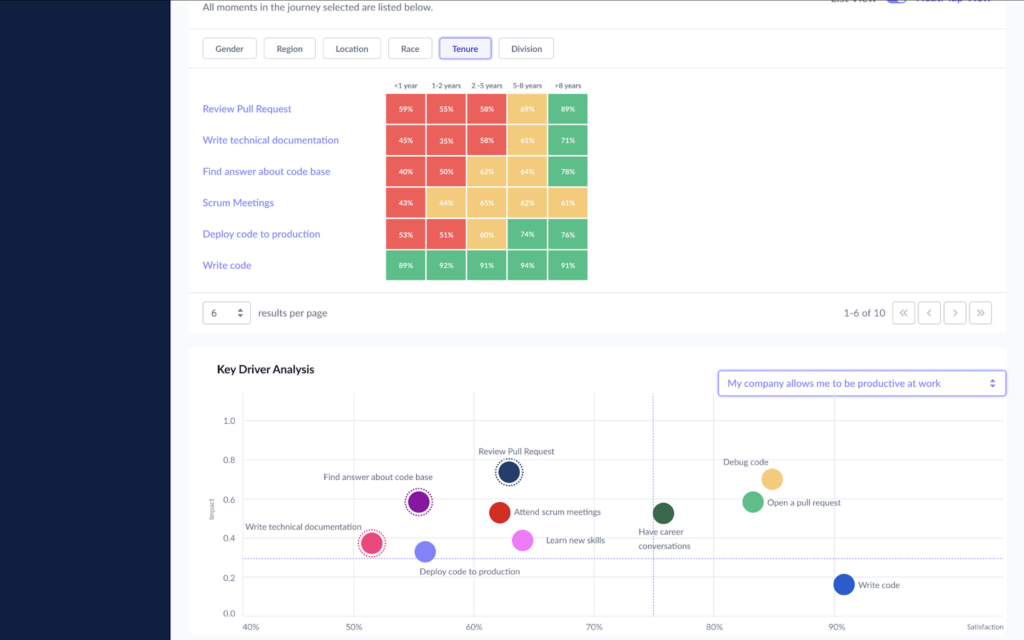

FOUNT questions, on the other hand, ask about the work itself: did the copilot make it harder or easier to review pull requests? How satisfied are you with the experience of using the copilot to review pull requests? Why?

The data that comes from these surveys is simple, too: it offers decision-ready insights.

For instance, you might see that junior developers struggle with AI chatbot responses during code reviews but are satisfied when using it to generate boilerplate code – pinpointing exactly where to invest in improvements.

Read the case study: $5.4M in Annual Savings by Leveraging GenAI Tools and Removing Work Friction

We gather this data based on a proven, proprietary system (Figure 2).

If you’re building a tool to identify opportunities for productivity increases and cost savings, you’ll need to make sure the survey component can ask questions that deliver decision-ready insights.

Question 3: Will Your System Scale?

FOUNT is built to scale. If you want to break a moment (a specific work activity) into multiple moments, you can do that without losing existing data. If you want to change the name of a touchpoint (the people, processes, or tools that support “moments”), for example, the new name autopopulates everywhere it’s being used.

When one of our customers tried to build a version of FOUNT in house, this was a particular pain point: when they wanted to change a term, they had to manually change it everywhere it appeared in the system.

It was particularly onerous because their system powered dozens of dashboards for various stakeholders across the organization, and they had to make changes for each dashboard.

Worse, they’d brought in consultants to do the initial survey question setup and had to tap those resources again when they needed to make changes. So while they were able to get to where they wanted, it was much more time- and cost-intensive than they’d hoped.

Question 4: Where Will You Get Your Survey Questions?

This is one area whose impact companies tend to underestimate. The assumption is generally that the IT setup will be the most complex part of building a FOUNT-like system in house.

In reality, the content of the questions is just as complex – and just as important to get right.

As we mentioned before: traditional employee survey tools are designed to get information about employee sentiment. People who are experienced users of these systems are great at coming up with sentiment-type questions. But they’re generally not familiar with how to ask questions to uncover the friction in the experience of getting work done.

For example, one customer that tried to build a system in house ended up asking questions that mixed up the role of moment and touchpoint. They ran initial surveys and got initial data but couldn’t figure out what to do with it.

This is because the questions weren’t structured to assess work.

FOUNT’s questions not only assess work, they go deeper and deeper until your organization has usable data on what to do about the problem areas our questions uncover.

What’s more, we have hundreds of questions from past surveys that we know work. Being able to use these on day one can save your organization months of time you’d otherwise spend drafting questions, testing them, refining them, and re-surveying employees until you got actionable data.

Question 5: What Will Your Time to Value Be?

When you work with FOUNT, time to value can be less than a month. Setting up and running an initial survey can take just a few weeks; from there, you’ll have clear insights into what’s holding your workers back from doing their jobs effectively. In just a matter of weeks, you’ll be able to create a roadmap for making changes that you can be confident will positively impact your bottom line.

If you build in house, time to value could be a year or longer. You have to…

- Scope the technical setup of the system.

- Build the system.

- Write survey questions.

- Conduct surveys.

- Assess data.

- Make changes based on the data.

The first three items will take the longest. But even once the system is up and running, getting decision-ready insights from your survey questions might not happen right away, as we explained above.

For one of our customers who initially tried to build their own version of FOUNT, it took a year to go from zero to running surveys – and those surveys ultimately didn’t yield data that was useful enough.

Question 6: What Will Your Maintenance Costs Be?

Finally, it’s important to consider what the ongoing costs of maintaining a home-built system will be.

One customer that attempted to build an in-house system needed two FTE employees to maintain it. The main reason was that their system didn’t include many of the automations FOUNT does.

Ultimately, they realized it was less expensive to work with FOUNT than to dedicate two FTEs to system maintenance. What’s more, working with FOUNT gives them access to more questions, easier-to-use dashboards, and better data.

To Build a Work Measurement Machine, You Need to Understand Frameworks and Methodology behind the Surveys

To build a system like FOUNT, you need the framework, the technical setup, the engine to power and send surveys, content for survey questions, and a data analytics layer to interpret the survey answers you gather.

None of those is easy to build. What makes them particularly challenging to do without expert guidance is that FOUNT’s surveys are not traditional employee experience surveys. Think of what we do: we’ve figured out how to ask precisely the right thing to get maximum actionability with relatively few data points.

The data – capturing changes in how work is experienced – gives you the clarity to see what’s working, what’s not, and where you can make changes to have a meaningful impact on workplace outcomes.

Related Resources

See all News

Insights

Build vs. Buy FOUNT: 6 Questions to Ask

Insights

AI Implementations Need Better Validation Metrics

Insights

March Newsletter: Don’t Use Old Methods to Measure A New Way of Working

Insights

AI Transformation Playbook: The Definitive Guide to Measuring, Rescuing, Prioritizing, and Scaling AI Transformations

Insights

How AI Tools Change Your Team’s Work (And What to Do About It)

Insights

You Just Deployed a New AI Tool. How Soon Can You Know if It’s Working?

Insights

Worker Impact Is the Common Denominator of Every AI Transformation – And the Best Early Indicator of Success

Insights

Data Deep Dive: The Origins of and Statistical Models Underpinning FOUNT’s Use of Data